46. I picked the wrong year to stop sniffing airplane glue - looking back at 2020 and to our future.

In this year-end installment of Feel the Boot, I want to, not surprisingly, look back at 2020 and also talk about some of the ideas I have for where Feel the Boot can go going forward.

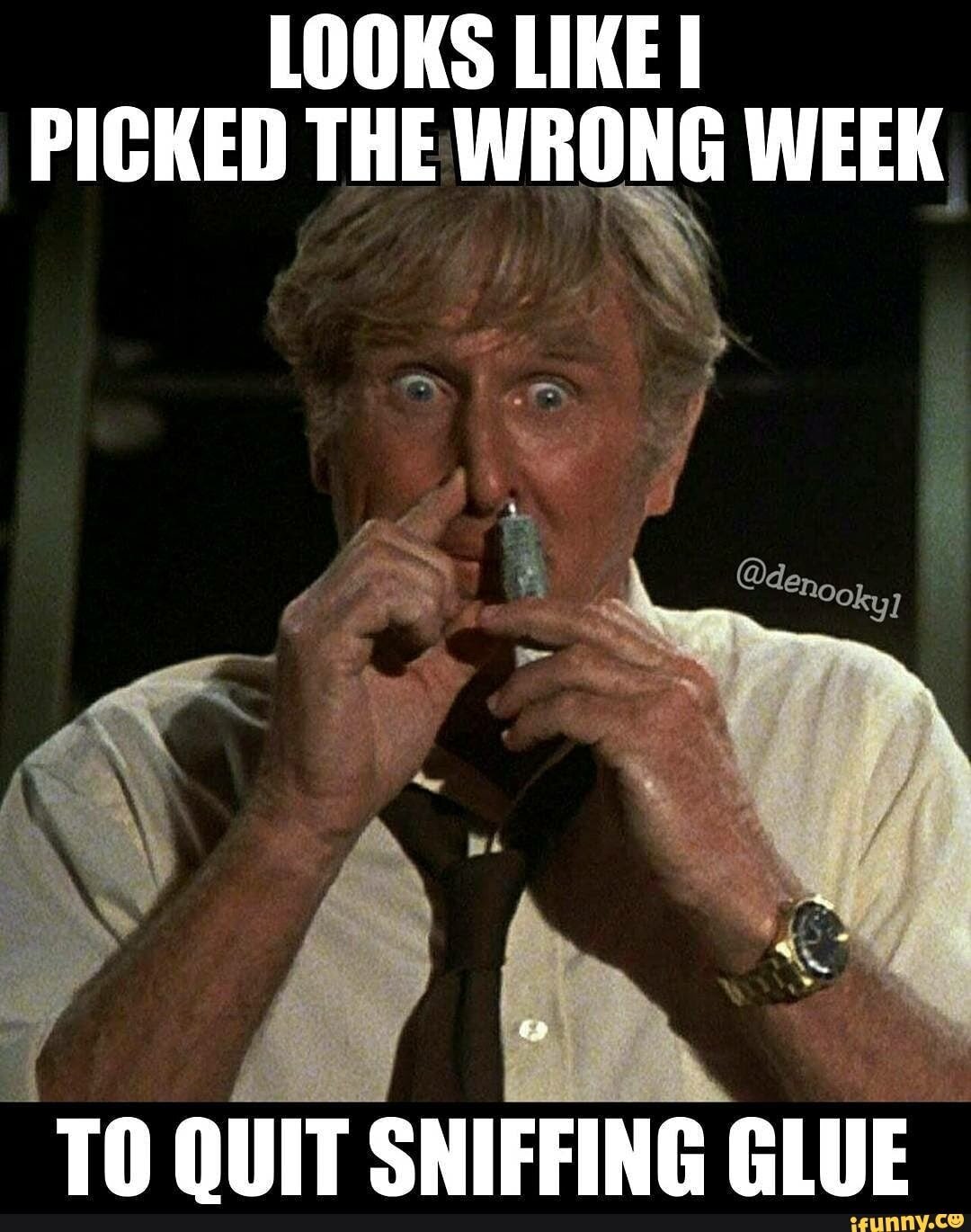

When I thought about this episode, the first thing that came to mind was the "I picked the wrong week to stop sniffing glue" scene from Airplane!

For those of you who aren't familiar with that reference, check the Wikipedia article. https://en.wikipedia.org/wiki/Airplane!

A time of transition

This year has been kind of a train wreck for almost all of us, and it made me realize how much privilege I have personally. I know many people who are having a rough time while I'm up here on a mountaintop with a beautiful view, a vineyard, and naturally isolated. Plus, I've been working from home for years, so not that much has changed for me.

The reason I thought about the "Picked the wrong year to quit sniffing airplane glue" is that at the beginning of this year, I chose to leave my job after 24 years. I founded Anonymizer in 1995, eventually exiting through an acquisition. I became the Chief Scientist of the company that acquired mine, which then got reorganized. I ended up doing PR for the company, public speaking, running the marketing department, and helping with sales and technology, all kinds of different jobs and roles. But fundamentally never had to jump off that cliff, as I did when I first started Anonymizer, until January 1 of this year. I decided to leave a job where they treated me very well and paid me well to go full-time with Feel the Boot, helping startups, advising mentoring, and Angel Investing. Of course, that meant I walked away from my entire income stream. Angel Investing is not a short-term returns kind of activity. Also, I don't charge for my advising. So, walking away from my paycheck was scary enough without doing it in a strange year like this. It wasn't just the risk of taking on this new role and focusing on this new kind of activity, but then there was the covid crisis, the pandemic, the lockdowns everything got transformed.

As usual, we had fires. I live up here, north of San Francisco, where the fire seems to come through every year. Fortunately, I didn't get evacuated this year. I got evacuated. In 2017 and 2019, but not in 2020, going against the pattern of things this year. The fires only came within a couple of miles of me, but I was able to wait them out at home. I had to use industrial Quality Air Filters to go outside, but even so, we did better than in some of the previous fire seasons.

New Roles

With this new focus on my advising activities, I took on some new roles. One of the things I'm doing now is chairing the selection committee at the North Bay Angels, which means I am in charge of looking at all of the companies applying to get funded and deciding which ones get to go through to present to the group as a whole. It is a severely narrow funnel. We might get 30 applicants in a two-month cycle. The committee will look at maybe 15 of them, with the rest dropped right off the bat. We pick five or six to present to the committee, and the committee then selects two or three to pitch to the whole group in that two-month cycle. That's why I talk so much about fundraising and how competitive it is. Many of the companies we reject are good companies with sound business plans.

One change we made this year is looking at companies from a much wider geographic area because of things like zoom and the fact that people don't need to travel to present to a group. Now it's not a hardship where someone needs to fly out to Sonoma for a chance at funding. They just need to show up for a quick Zoom meeting. Rather than being exclusively Bay Area focused, the North Bay Angels is now looking at applicants from anywhere around the country. The dissolving of geographical borders is a big trend in the investment community right now.

The other activity I have taken on this year is becoming a global entrepreneur in residence for the Founder Institute. With them, I provide advice to the companies in their program anywhere around the world. Founder Institute is a global organization with chapters in 90 countries. I might have office hours with someone in Toronto, and then the next call with someone in London, Sydney, Cape Town, or Hong Kong. These days I open my sessions by guessing whether it's day or night by the light in their room and then asking where they are. It's fascinating to see all the different kinds of businesses they're launching relevant to their specific geographic areas.

I'm finding that this Covid lockdown environment has been a real boon for my ability to engage with the startup community without regard to driving distance. Before this, I would usually have to go down to San Francisco for most activities. That's at least an hour drive in good traffic, and it's rarely good traffic, to attend a meeting for an hour or two and then drive back. So I didn't do that very often. Whereas now that I can just jump on the zoom, I'm going to tons of these kinds of events. They give me exposure to a much greater range of companies in different situations doing different types of things. Those experiences informed many of the videos I created this year.

Most frequent advice of 2020

I don't know if it's something about the plague that we're having, but I've noticed that I seem to be giving two pieces of advice more than I ever remember doing before. The first is about the need to focus on talking about what your business is. More than ever, I'm seeing pitches laser in on some technical aspect of the business, or diving into jargon, and skipping answers to the big picture questions. Who are you doing this for? Why are you doing it? What is the business? How does this make money? Why do people want to pay for it? I need to understand these big dumb picture items before I can appreciate the subtle aspects of exactly how you're accomplishing what you're doing or what's unique about your technology.

The other theme of my 2020 advising has been narrative. Convincing people that they need to spend more time telling stories. They present a lot of facts, and they've got compelling data, but it's hard to digest it and contextualize it when it's just presented in that raw form. I think most of the companies I'm looking at would do much better if they could tell a story about their customers, the problems they're having, and why engaging with this product will benefit them.

I am not sure why those two are coming up over and over this year, but it's definitely a pattern. I'm curious to see whether that continues into 2021.

Feel the Boot going forward

Speaking of 2021, I think we're going to be doing some reorganizing of the Feel the Boot content. Starting off, I only had a couple of episodes, so the blog format worked well. Now that I have 40+ episodes recorded, and by the end of next year it'll be a lot more, we need to find ways of making this content more accessible. We must ensure that when you come in looking for an answer to a certain kind of question, you can immediately find the episode or the blog or the content that's relevant to what you need to know as opposed to digging through them all in chronological order. So I'm going to be spending more time thinking about how I can curate the information to make it more useful.

I'm also considering creating more of a course like structure. Rather than just having an episode on whatever topic occurred to me after talking to some founder, I could try creating a series on getting started, finding product-market fit, doing experiments, or what have you. The episodes would flow together in a logical way to create a program Founders could go through, for free, to take them from point A to point B. From getting their funding rounds, or not getting their funding rounds and bootstrapping their way up, to eventually reaching whatever level of success they're shooting for.

I also think that it might make sense to start pulling this together into a book, so one of the projects that I'm going to be looking at this year is whether I can take all of this content that I've created and distill it down into a volume which would provide that clear roadmap of progress making it much easier to find or refer back to relevant information when experiencing particular problems as you go through different phases of growth.

Finally, your feedback would be invaluable in helping guide our direction. What kinds of content would you like me to create? How can I, and Feel the Boot, be maximally useful to you as a Founder? What kind of problems are you having? What kind of information or answers are you unable to find in other places? Many other people are writing and blogging on these topics, but you're here for a reason. How can I make this more effective and productive for you? Let me know what you like, what you don't, and how I can improve.

Until next time, next year, ...

Ciao.